Introducing TransferNow- External Transfer

All accounts will need to be established through the consumer online banking and complete the verification process In order to initiate transfers from your mobile device.

External Transfer offers the following features:

- Send/Receive one-time transfers

- Scheduled future transfers

- Scheduled recurring transfers

- Standard and next-day delivery

services (Next-day transfer services are available based on a series of standard qualification rules)

- External account validation when establishing a new account

- Real-time and trial-deposit account verification methods

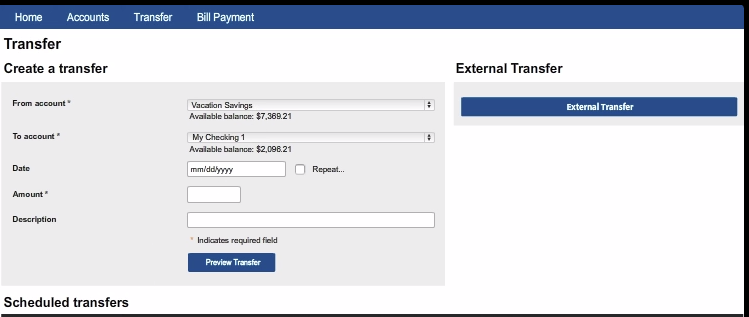

To get started log into your online banking and select Transfer and then select External Transfer.

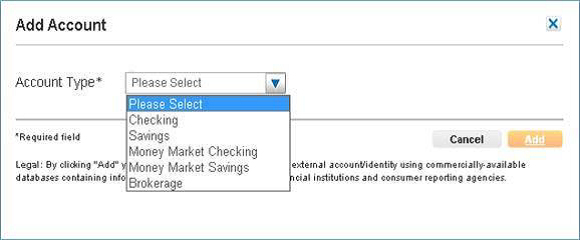

On the Add Account page, select the Account Type, and then click Add.

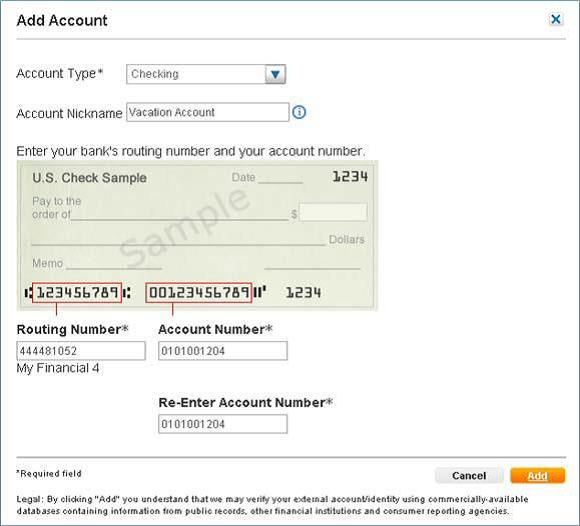

On the Add Account page, type the appropriate information in the required boxes denoted by the asterisk (*), and then click Add. Up to five accounts may be added.

Note: Account Nickname only appears on the Manage Accounts page.

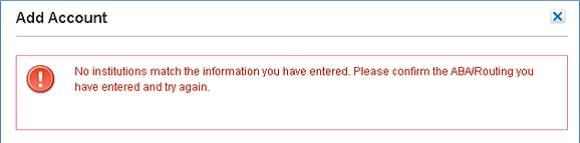

Note: When a valid routing number is entered, the associated financial institution name appears under the Routing Number box. If the routing number is not found, the error message below appears. Some financial institutions may use a different routing number for electronic transactions than what is printed on the check.

When an account is successfully added, the account must be verified and activated before transfer services are available. The account verification process occurs immediately after an account has been added.

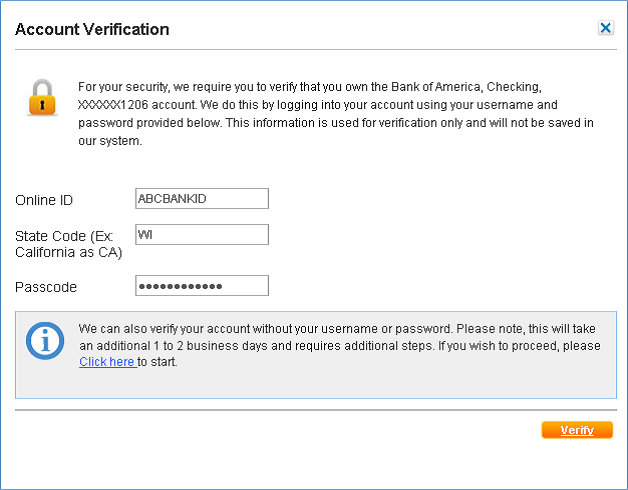

Real-Time Account Verification

Real-time account verification cross-validates the Internet banking/brokerage website using your supplied credentials to match username and account number details against user supplied information during the account verification process.

If real-time verification is available for the applicable account, an Account Verification page appears immediately following the addition of a new account.

To begin Real-Time Verification:

- Type the Online ID (user name), two-digit State Code of the account’s resident financial institution’s location, and the Passcode (password) for the online banking account held at the external financial institution.

- Click Verify.

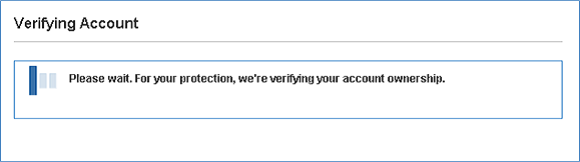

The verification process may take several minutes based on Internet connection and computer speeds. A message appears during the validation process.

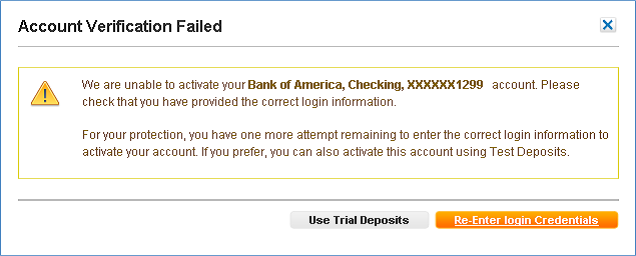

If the real-time account verification process fails during the validation attempt, an Account Verification Failed message appears. - To attempt real-time account verification a second time, click Re-Enter login Credentials.

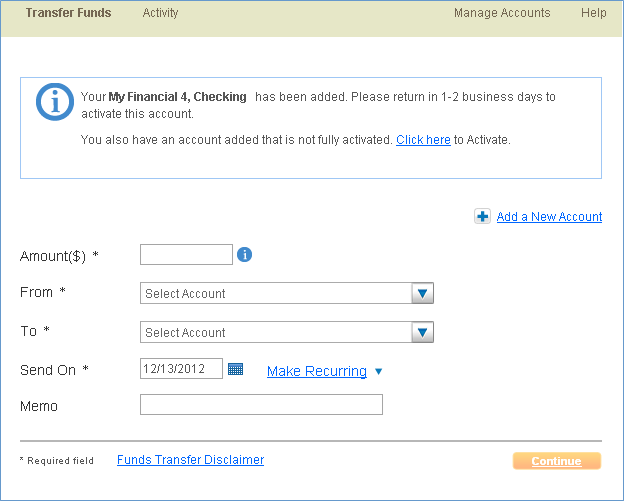

You may attempt real-time account verification a maximum of two times. If you re-enters your credentials and it fails a subsequent time, you must use trial-deposit account verification. After accepting the forced trial-deposit account verification prompt, the following page appears

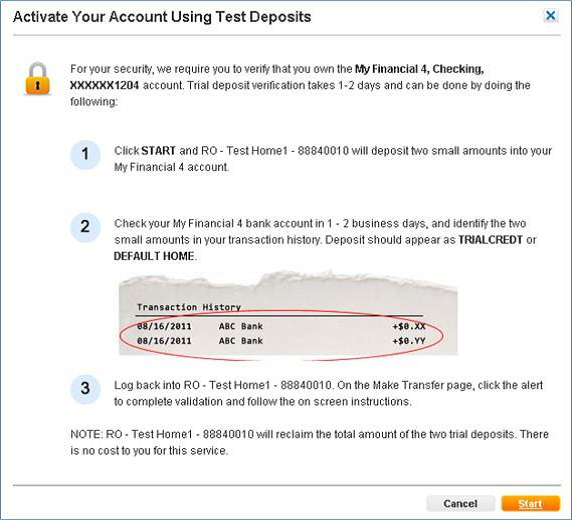

Trial-Deposit Account Verification

The prompt for trial-deposit account verification occurs immediately if real-time account verification is unavailable.

- To begin trial-deposit

account verification, click

Start.

- On the confirmation page, click Done.

Two nominal credits (for example, $0.10 & $0.20) and one debit of equal value (for example, $0.30) are generated to the external account within one to two business days.

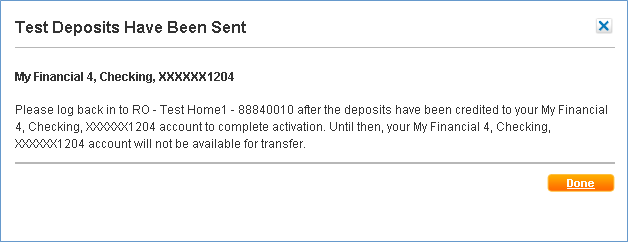

Activating an Account

Once deposit verifications in the external account have been confirmed, the account must be activated by entering the deposit amounts in External Tansfers.

To activate an account:

- On the home page, click Manage Accounts.

- In the status column of the associated account, click Activate Now.

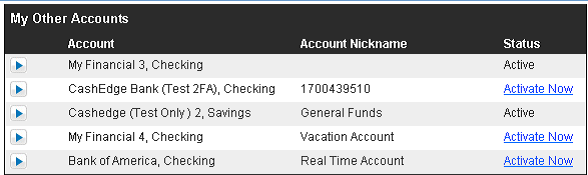

Type the two deposit amounts, which were retrieved from the external account’s recent history and click Activate.

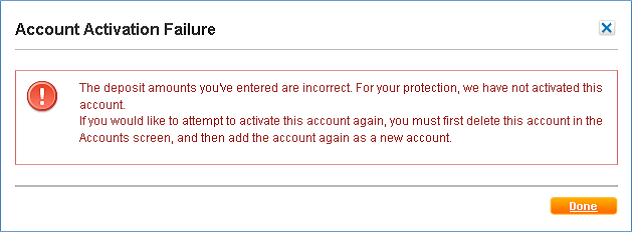

If the deposit amounts entered match the trial-deposit amounts, the account is activated. If the deposit amounts do not match, the following message appears.

Retype the two deposit amounts, which were retrieved from the external account’s recent history and click Activate.

Account activation may be attempted a maximum of two times. If incorrect deposit amounts are typed the second time, the account will be placed in suspense from further activity. The user must delete the suspended account and re-enter the account as a new account.

When a second failed attempt for verification is entered, the following message appears.

Fund Transfers

After adding and verifying the account ownership, you can setup one-time transfers and recurring transfers within online banking or your mobile device. Transfers cannot be made to unverified, suspended, or deleted accounts.

Once an external account is established, transfer service requests may be created, reviewed, edited, and deleted.

Note: Transfers completed via External Transfer must consist of one external account and one internal account. Transfers may not consist of two direct internal accounts or two direct external accounts.

One-Time Transfers

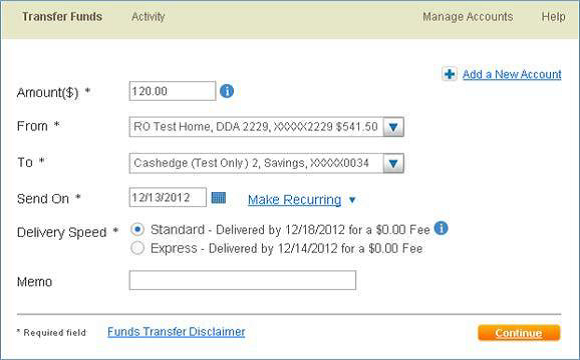

To complete a One-Time Transfer:

- Click Transfer Funds.

- In Amount( $), type the desired transfer amount.

- From the To and From lists, select applicable accounts.

- In the Send On box, type the desired date in MM/DD/YYYY format or click the Calendar and select a date.

- Select the appropriate Delivery Speed option button. (Delivery speed options available are based upon qualification requirements).

- If information is needed for future reference, in the Memo box, type the information.

- Click Continue.

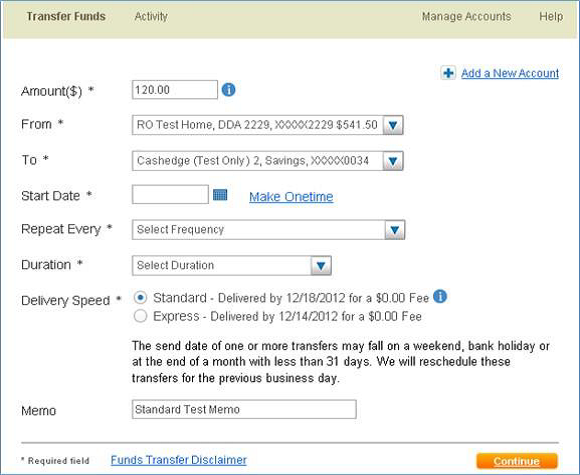

To schedule a recurring transfer:

- Click Transfer Funds.

- In the Amount ($) box, enter the transfer amount.

- From the To and From lists, select applicable accounts

- Click the Calendar next to the Start Date box, and then click an available highlighted transfer date, or type a date.

- Click Make Recurring.

- In the Repeat Every list, select the Frequency.

- From the Duration list, select the duration for the recurring transfer.

- Select the appropriate Delivery Speed option button.

- If information is needed for future reference, in the Memo box, type the information.

- Click Continue.

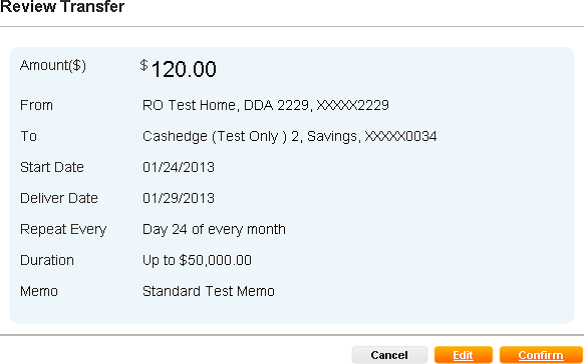

- On the Review Transfer page, click Edit to

make any changes, or click

Confirm to complete the transfer request.

Standard Transfers

Standard funds transfers are typically completed within three business days. The completion of a transfer, including the availability of funds in the destination account and access to transaction details, depends how quickly the financial institution updates their accounts after receiving funds transfer information.

Funds are posted to the destination account before start-of-business on the third business day after the funds are withdrawn from the source account. Federal Reserve holidays and/or New York Stock Exchange (NYSE) holidays extend the transaction cycle for standard transactions.

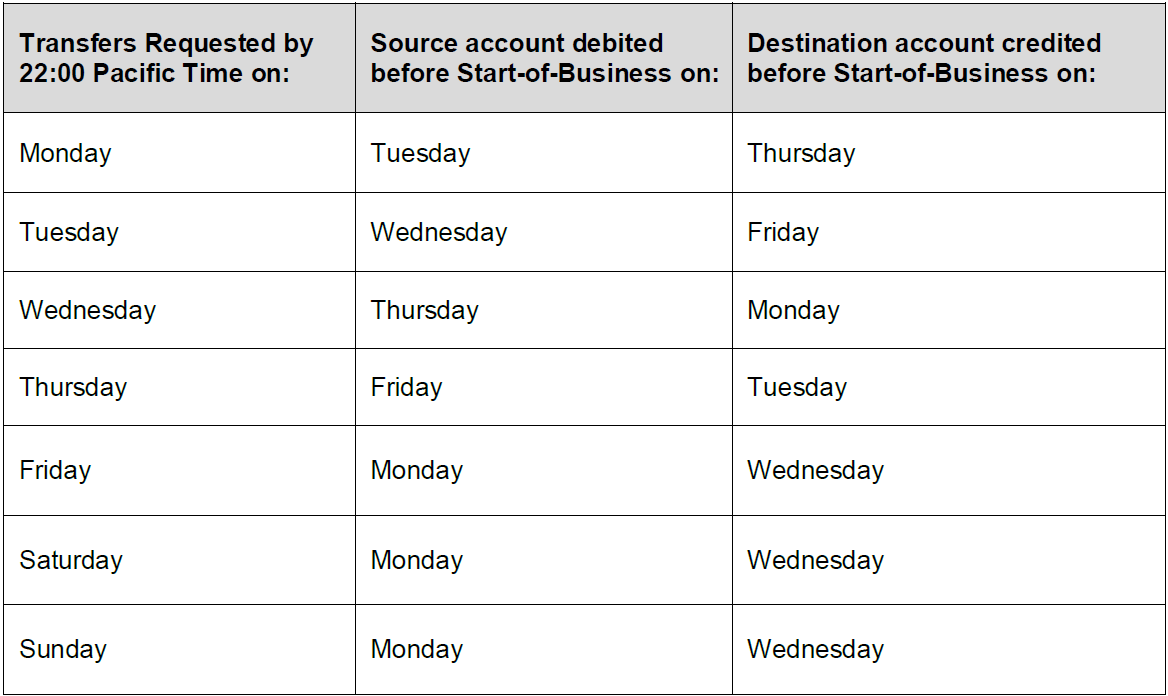

Standard Transfer Transaction Cycles

Next-Day Transfers

Next-day ACH transfers are inter-institution transfers in which both the debit and credit of the transaction settle the next business day via ACH. The completion of a transfer, including the availability of funds in the destination account and access to transaction details, depends how quickly the financial institution updates their accounts after receiving funds transfer information.

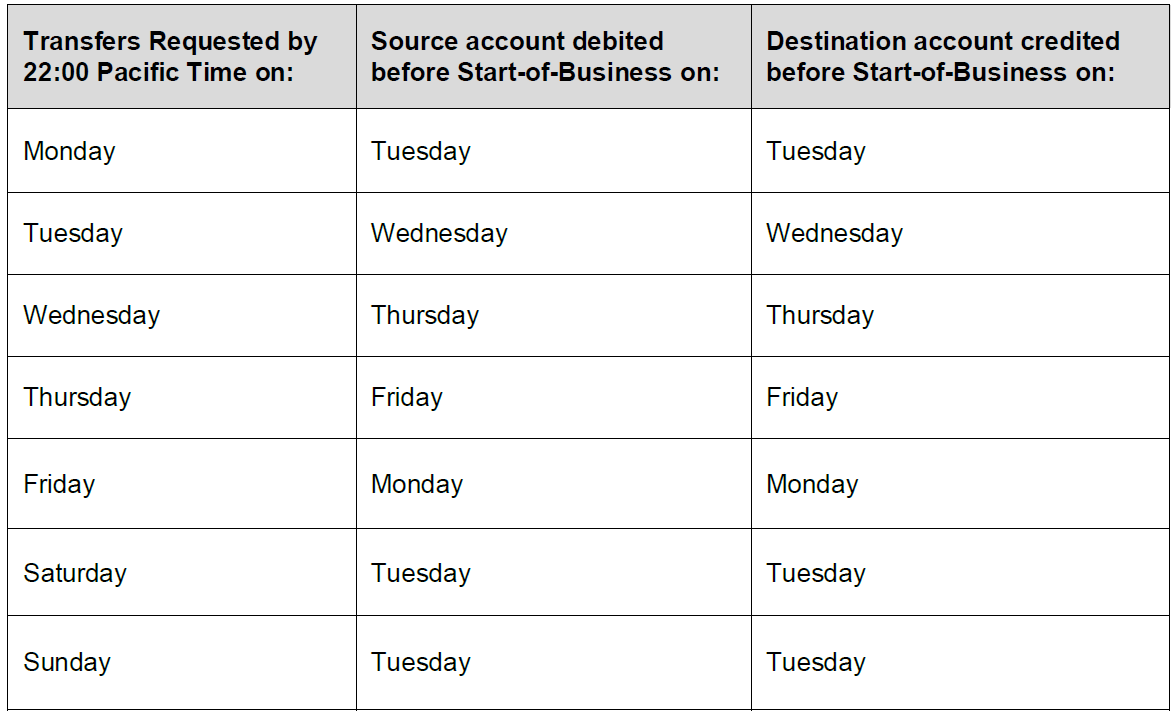

Next Day Transfer Transaction Cycles

Accounts must qualify for

next-day transfer service. If an account does not qualify, the next-day option

is not available.

To qualify for next-day

transfers, you must satisfy qualification rules set forth in the following

table.

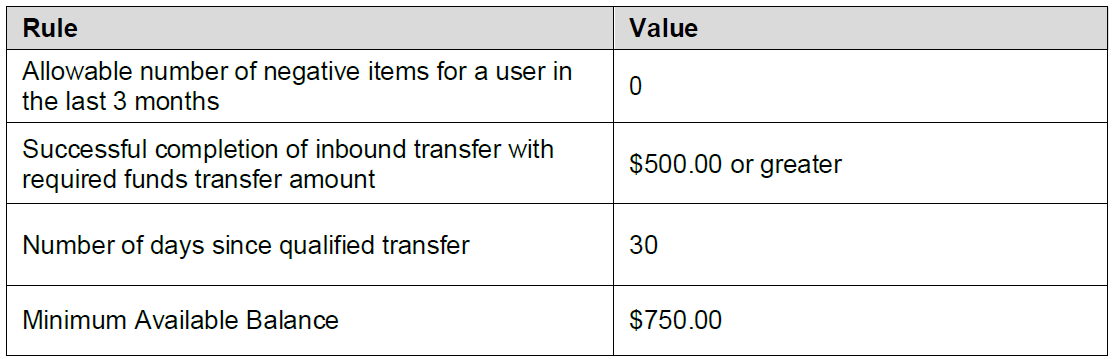

Inbound Next Day

Transfer

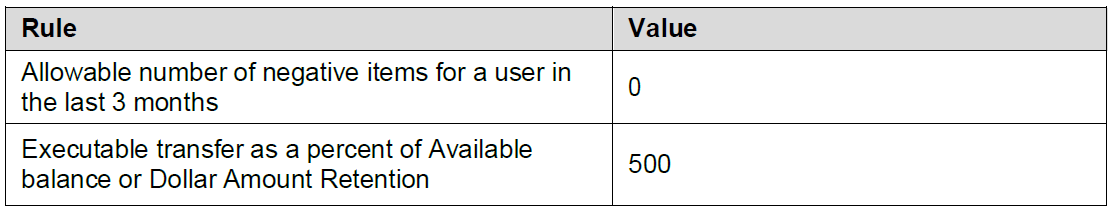

Outbound Next Day Transfers

Transfer Cutoff Times

Overview

Cutoff time guidelines are as follows:

Standard Transfers

- Debit posts on the next ACH processing day.

- Credit will not post until the debit has settled, typically three ACH processing days from the original transaction request.

- Cutoff time is 10:00 PM Pacific Time (add one day if after cut off time).

- Debit and Credit post on the next ACH processing day.

Next-Day Transfers

- Debit and Credit post on the next ACH processing day.

- Cutoff time is 5:00PM Pacific Time (add one day if after cutoff).

Questions

If you have questions, please visit our or contact us at 888-683-6030 for assistance.